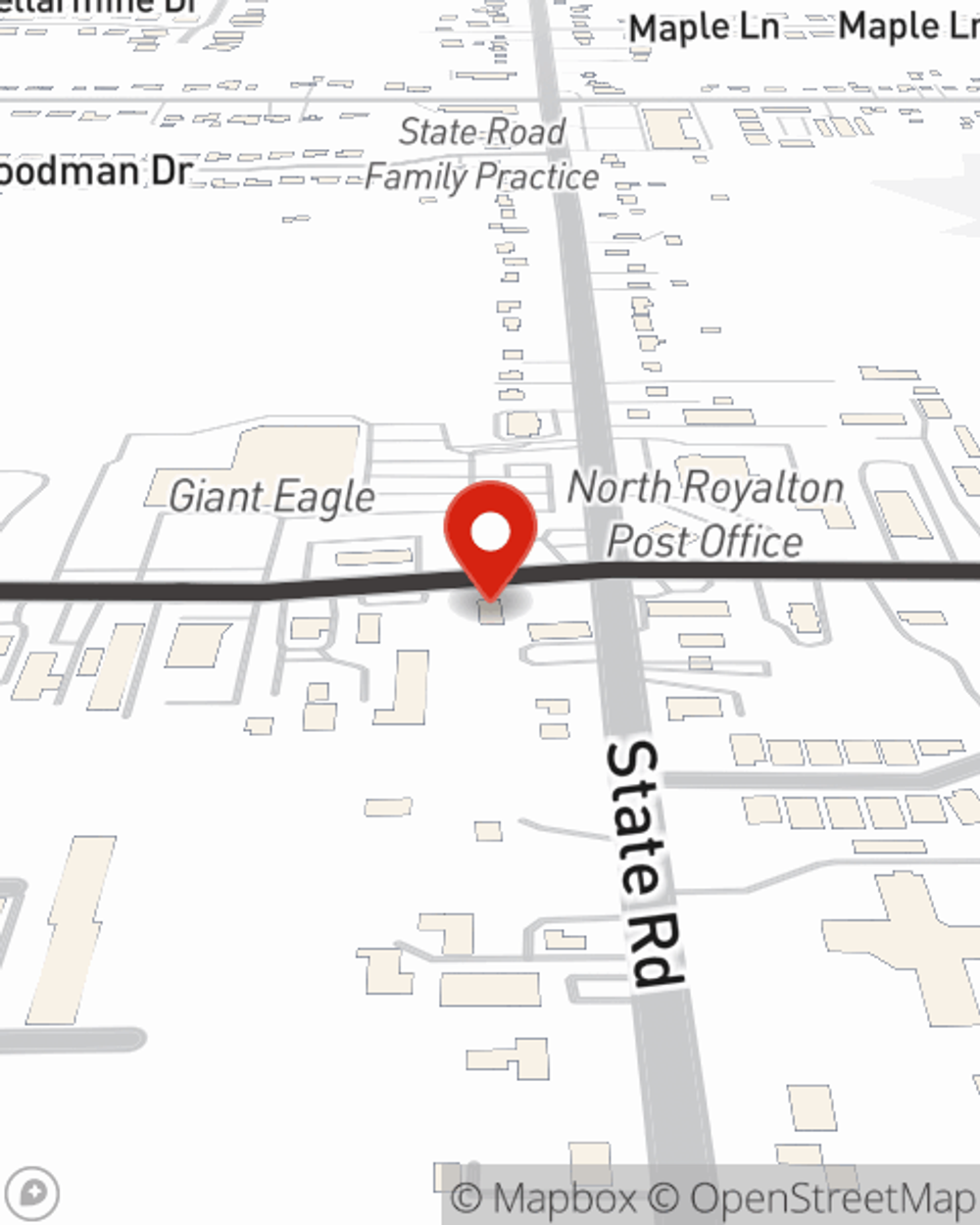

Business Insurance in and around North Royalton

Looking for small business insurance coverage?

Insure your business, intentionally

Business Insurance At A Great Value!

Running a small business comes with a unique set of highs and lows. You shouldn't have to wrestle with those alone. Aside from just those who care for you, let State Farm be part of your line of support through insurance options including worker's compensation for your employees, errors and omissions liability and business continuity plans, among others.

Looking for small business insurance coverage?

Insure your business, intentionally

Insurance Designed For Small Business

Why choose State Farm for coverage? Your fellow business owners have rated State Farm as one of the top overall choices for insurance coverage by small business owners like you. You can work with State Farm agent Tina Stopar for a policy that covers your business. Your coverage can include everything from a surety or fidelity bond or extra liability coverage to mobile property insurance or key employee insurance.

Get right down to business by contacting agent Tina Stopar's team to discuss your options.

Simple Insights®

How to spot a roof leak and what to do if you have one

How to spot a roof leak and what to do if you have one

From mold on the roof to missing shingles, learn how to find roof leaks and know what to do.

Key employee coverage issues

Key employee coverage issues

The death/disability of a key person can have a dramatic impact in a smaller business. Consider these questions to help determine discount factor percentage.

Tina Stopar

State Farm® Insurance AgentSimple Insights®

How to spot a roof leak and what to do if you have one

How to spot a roof leak and what to do if you have one

From mold on the roof to missing shingles, learn how to find roof leaks and know what to do.

Key employee coverage issues

Key employee coverage issues

The death/disability of a key person can have a dramatic impact in a smaller business. Consider these questions to help determine discount factor percentage.